Weekly Market Insights | August 19th, 2024

The S&P 500’s Best Weekly Gain of The Year.

Stocks posted solid gains last week, buoyed by robust economic data and constructive comments from Fed officials.

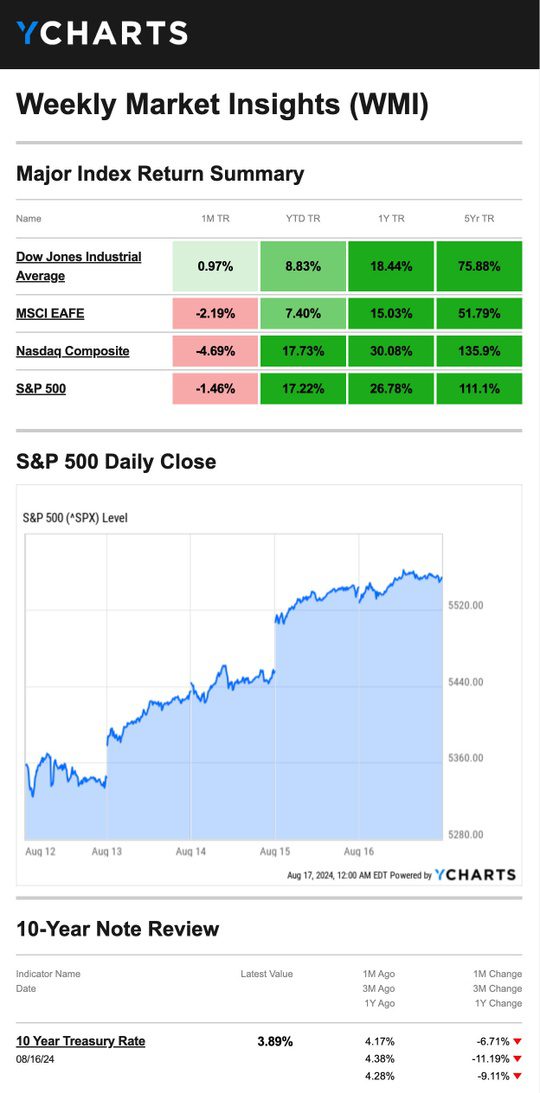

The Standard & Poor’s 500 Index rose 3.93 percent, while the Nasdaq Composite gained 5.29 percent. The Dow Jones Industrial Average lagged a bit, picking up 2.94 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, powered ahead by 4.31 percent.1,2

Upbeat Economic News

Three critical economic data points gave investors what they were looking for: wholesale inflation, consumer prices, and retail sales.

Both the Producer Price Index and the Consumer Price Index rose less than expected in July, reinforcing a picture of cooling inflation. The July retail sales report on Thursday was stronger than expected, which added more fuel to the week-long rally.3,4,5

Market action slowed down on the week’s final trading day, with positive consumer sentiment gains countered only by a drop in housing starts.

It was the S&P 500’s best weekly gain of the year so far and the best since November of 2023. The gains helped erase losses from earlier in the month, when “carry trades” news from Japan unsettled investors.6,7

|

|

Double Assist

Last week’s market rally saw assists from two places: economic data and constructive Fed comments.

On Thursday, Atlanta Fed President Raphael Bostic said he had “a lot more confidence that inflation’s sustainably on its way to 2%,” citing steady drops in CPI. And St. Louis Fed President Alberto Musalem said, “the time may be nearing when an adjustment (to the Fed Funds Rate) may be appropriate.8

This Week: Key Economic Data

Monday: Leading Indicators.

Wednesday: FOMC Meeting Minutes.

Thursday: Jackson Hole Economic Symposium. Jobless Claims. Existing Home Sales.

Friday: Jackson Hole Economic Symposium. New Home Sales. Fed Chair Jerome Powell speaks.

Source: Investors Business Daily – Econoday economic calendar; August 16, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Monday: Palo Alto Networks, Inc. (PANW)

Tuesday: Lowe’s Companies, Inc. (LOW)

Wednesday: The TJX Companies, Inc. (TJX), Analog Devices, Inc. (ADI)

Thursday: Intuit Inc. (INTU)

Source: Zacks, August 16, 2024

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Food for Thought…

““Spread love everywhere you go. Let no one ever come to you without leaving happier.”

– Mother Teresa

Tax Tip…

Who Qualifies for the Child and Dependent Care Tax Credit?

Let’s outline who the Internal Revenue Service (IRS) defines as a qualifying person under this care credit:

- A taxpayer’s dependent who is under the age of 13 when the care is provided.

- A taxpayer’s spouse who is physically or mentally unable to care for themselves and lived with the taxpayer for more than half the year.

In addition to spouses and dependents, the credit may also cover someone who is mentally or physically unable to care for themselves and lived with the taxpayer for six months; this is the case if that person was the taxpayer’s dependent or if they would have been the taxpayer’s dependent except for one of the following:

- The qualifying person received a gross income of $4,700 or more.

- The qualifying person filed a joint return.

If filing jointly, the taxpayer or spouse could be claimed as a dependent on someone else’s return.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov9

Healthy Living Tip…

What Are Essential Oils?

You’ve likely heard about the many potential benefits of essential oils, but what exactly are essential oils?

Essential oils are compounds extracted from plants, obtained through distillation or cold pressing. The best essential oils are pure, with no other chemicals added. In addition to using essential oils in a diffuser as aromatherapy, you can apply them topically. Inhaling the aromas from essential oils may stimulate areas of your limbic system, which is a part of your brain that plays a role in emotions, behaviors, sense of smell, and long-term memory.

Tip adapted from Healthline10

Weekly Riddle…

It stands higher than any tree, yet it seemingly takes forever to grow, and you can’t see its roots. You won’t have to shimmy up any trunk to reach its top. What is it?

Last week’s riddle: There are three cups of flour on a counter and you take one away. How many cups of flour do you have now? Answer: You have one cup of flour, as you have taken one away.

Photo of The Week…

Zabriskie Point in Death Valley National Park

Death Valley, California, United States,

Footnotes And Sources

1. The Wall Street Journal, August 16, 2024

2. Investing.com, August 16, 2024

3. The Wall Street Journal, August 13, 2024

4. The Wall Street Journal, August 14, 2024

5. The Wall Street Journal, August 15, 2024

6. The Wall Street Journal, August 16, 2024

7. CNBC.com, August 16, 2024

8. The Wall Street Journal, August 15, 2024

9. IRS.gov, May 8. 2024

10. Healthline, May 8, 2024

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2024 FMG Suite.