Presented by APEX Financial Group/Mount Vernon Investment

Market timing is exhausting. And sometimes, it can be expensive. When you time the markets, you have to be right twice – first when getting out and second when getting back in.

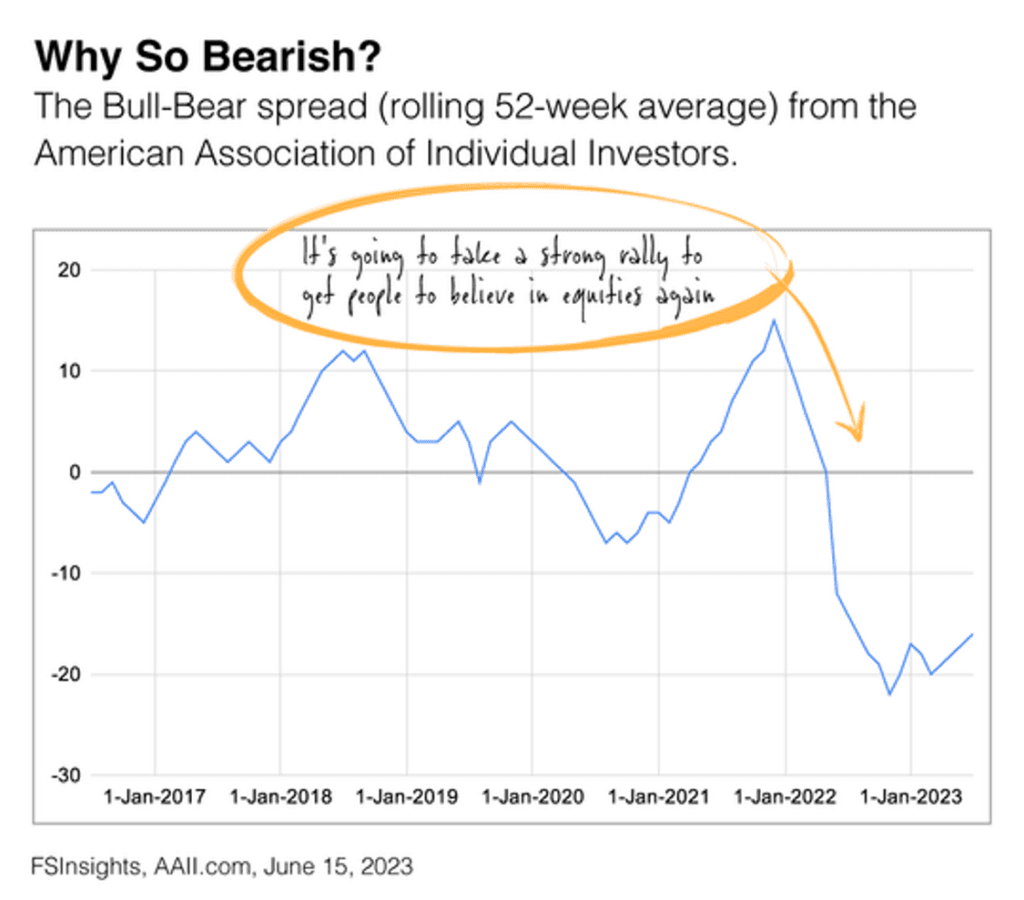

In the accompanying chart, you can see individual investors remain mostly “out” despite the stock market’s 2023 rally.1

While the chart shows individuals are becoming more upbeat about stock prices in recent months, there’s still much skepticism. After all, it can be challenging to break from a bearish mindset if you’ve been in that camp for a while.

With investing, it’s critical to “tune out the noise” and focus on what you can control. Having a strategy aligned with your goals, time horizon, and risk tolerance is critical, and it can help you stay focused when market sentiment turns negative.

I can promise plenty of unsettling headlines in the months ahead. The bears will have plenty of reasons to stay on the sidelines if they are looking for one.

- Stocks are represented by the S&P 500 Composite Index, which is an unmanaged index that is considered representative of the overall U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost.