Weekly Market Insights | August 26th, 2024

The Dow Jones Industrial Average picks up.

Stocks notched a solid gain as dovish comments from Federal Reserve officials boosted the market’s recovery from early August lows.

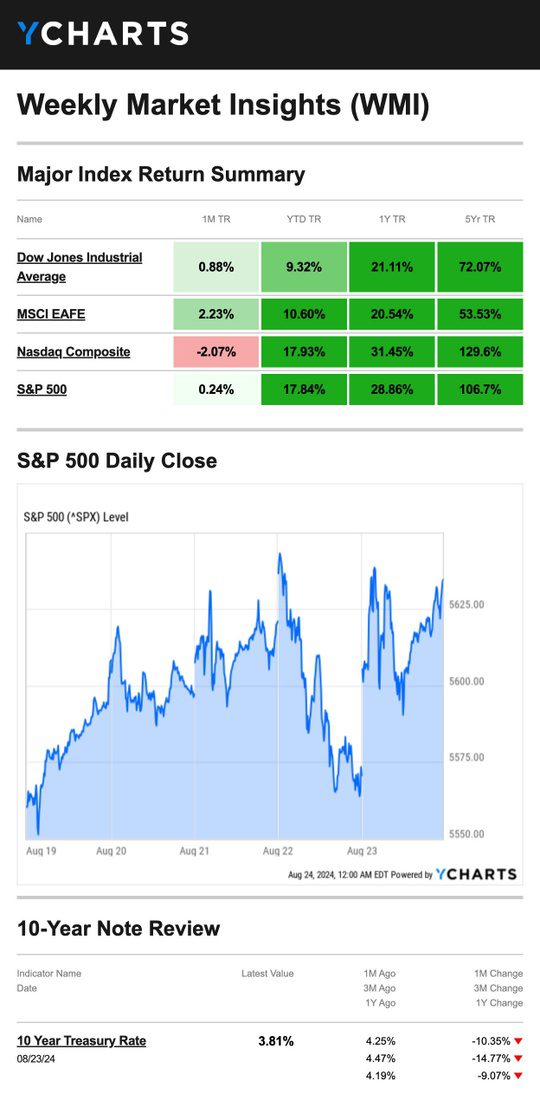

The Standard & Poor’s 500 Index rose 1.45 percent, while the Nasdaq Composite added 1.40 percent. The Dow Jones Industrial Average picked up 1.27 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, gained 2.98 percent.1,2

Dovish Week

Stocks started the week strong, rallying after Wall Street welcomed dovish comments from Minneapolis Fed President Neel Kashkari. The S&P 500 and Nasdaq each posted gains on Monday–the 8th consecutive winning session. The Dow rose for the 5th session in a row.3,4

From there, markets traded in a narrow band until Wednesday afternoon when minutes released from the July 30-31 FOMC Meeting revealed more dovish comments. On Thursday, stocks dipped ahead of Fed Chair Jerome Powell’s annual Jackson Hole, Wyoming, speech.5,6

Well-received comments from Powell on Friday boosted markets, with all three averages closing higher.7

|

|

“The Time has Come”

The Fed’s annual symposium for global central bankers started Friday morning with Fed Chair Powell’s much-anticipated speech. Citing the risk of the labor market cooling even further, he said, “the time has come for policy to adjust.”

Investors responded favorably, with the remaining question being how significant a rate cut might be. Powell kept that door open, adding that “the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”8

This Week: Key Economic Data

Monday: Durable Goods.

Tuesday: Consumer Confidence. Case-Shiller Home Price Index.

Wednesday: Fed Official Raphael Bostic speaks.

Thursday: GDP. International Trade in Goods. Jobless Claims. Pending Home Sales.

Friday: Personal Income and Outlays. Consumer Sentiment.

Source: Investors Business Daily – Econoday economic calendar; August 23, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Wednesday: NVIDIA Corporation (NVDA), Salesforce Inc. (CRM)

Thursday: Dell Technologies Inc. (DELL)

Source: Zacks, August 23, 2024

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Food for Thought…

“In a gentle way, you can shake the world.”

– Mahatma Gandhi

Tax Tip…

Gig Economy Tax Tips

There are some essential tips to remember if you work as a gig worker, someone who takes temporary work through one or more employers:

- All income from these sources is taxable, regardless of whether you receive information returns; this includes both full-time and part-time work and if you’re paid in cash.

- As a gig worker, you must be correctly classified as an employee or an independent contractor; this can depend on where you live, even for the same services.

Lastly, it’s important to remember to pay the correct amount of taxes on this income throughout the years to avoid owing when you file. Because gig employees don’t have an employer withholding taxes from their paychecks, they can either submit a new W-4 and have their employer withhold more from their paycheck (if they have another job as an employee) or make quarterly estimated tax payments throughout the year.

*This information is not intended to be a substitute for specific, individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov9

Healthy Living Tip…

Boost Your Productivity With These Tips

Take regular breaks. It seems counterintuitive, but most people are more productive when they take regular breaks.

Do the challenging tasks first. Mark Twain famously said to “eat the frog first thing in the morning,” meaning you should tackle your most difficult task immediately.

Make two to-do lists. One that has your weekly goals and objectives and one that has your daily tasks.

Divide large projects into manageable steps. Make the things on your to-do list specific so you can continue to cross things out and make progress.

Tip adapted from Formstack10

Weekly Riddle…

Anna, a supermarket clerk, has not slept during any of the past six nights, yet she is not tired. How can this be?

Last week’s riddle: It stands higher than any tree, yet it seemingly takes forever to grow, and you can’t see its roots. You won’t have to shimmy up any trunk to reach its top. What is it? Answer: A mountain.

Photo of The Week…

Moraine Lake

Banff National Park, Canada

,

Footnotes And Sources

1. The Wall Street Journal, August 23, 2024

2. Investing.com, August 23, 2024

3. The Wall Street Journal, August 23, 2024

4. The Wall Street Journal, August 19, 2024

5. MarketWatch.com, August 22, 2024

6. Reuters.com, August 22, 2024

7. The Wall Street Journal, August 23, 2024

8. The Wall Street Journal, August 23, 2024

9. IRS.gov, May 8. 2024

10. Formstack, May 8, 2024

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2024 FMG Suite.